Beautiful Work Info About How To Buy Chinese Bonds

The only practical way that i know of for a us retail investor to purchase chinese government bonds are through a fund.

How to buy chinese bonds. 1938 republic of china, 27th year, english face, chinese back. Most of it is owned by domestic actors, either consumers, banks, or institutions like the federal reserve. China invests heavily in u.s.

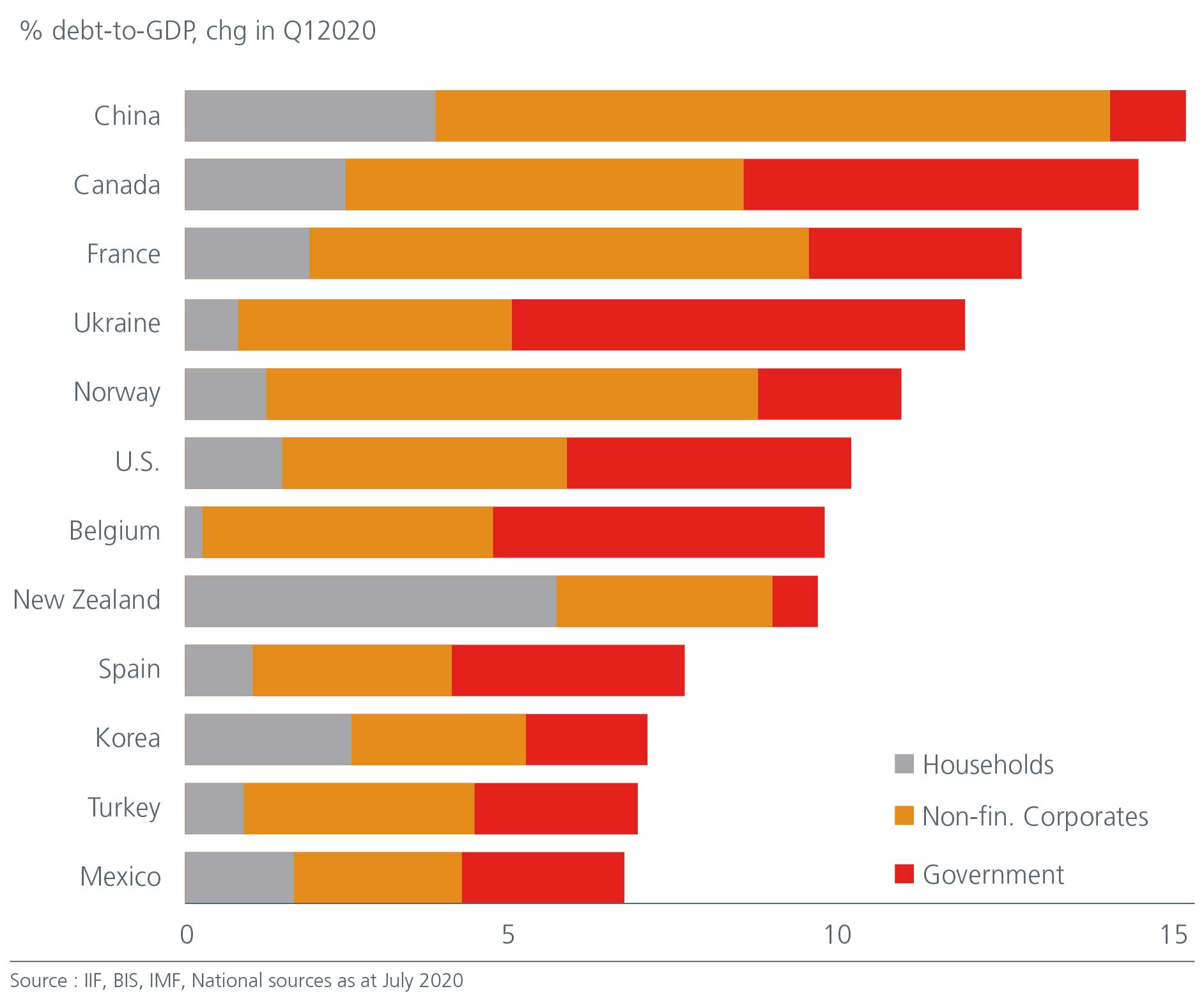

China has not launched a “southbound” channel, which would allow chinese investors to invest in offshore bonds. The problem of blind greed. Compare that to the u.s.

You also can set up. Login to your account and click the buydirect® tab. 10 years vs 2 years bond spread is 64.1 bp.

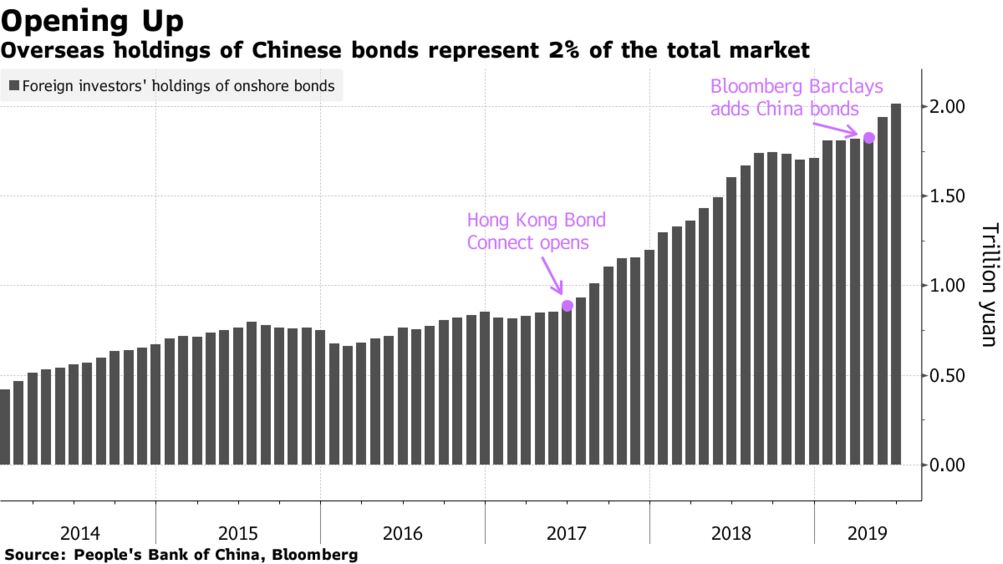

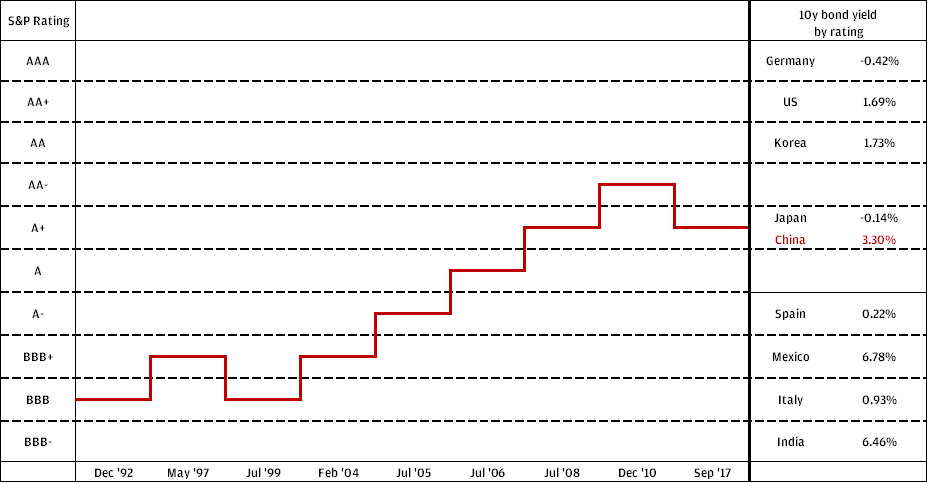

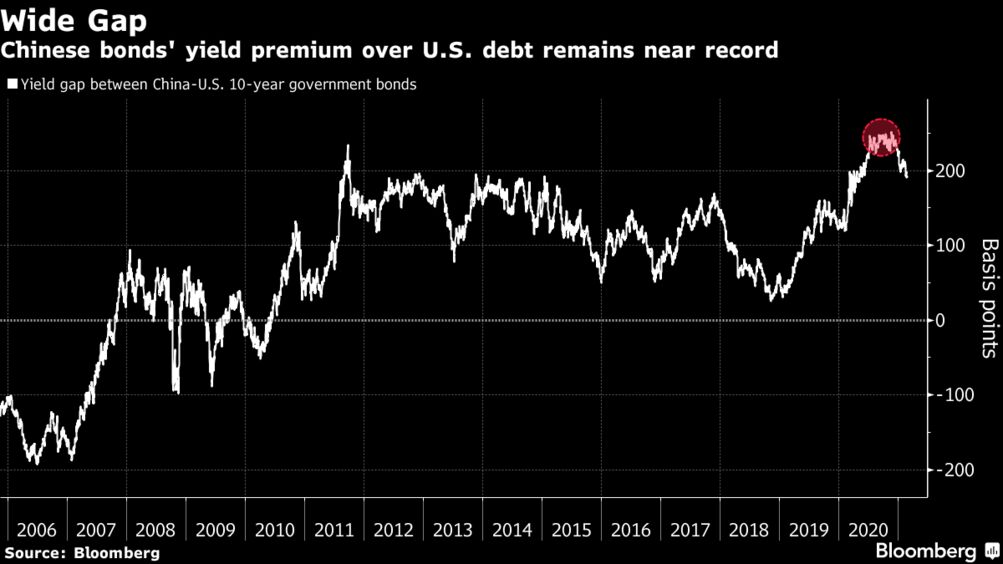

At 2.97% or germany at 0.63% or japan at 0.04% and it makes sense why these bonds are. Follow the prompts to specify the security you want, the purchase amount, and other requested information. The growth of the china bond market, in size and complexity, is providing a wealth of opportunities for investors.

If the exchange rate stayed the same, that 505,000 yen would be worth $5,050. Stay on top of current data on government bond yields in china, including the yield, daily high, low and change% for each bond. Trillion in market size 1.

1 day agothe european central bank (ecb) will tilt its purchases of corporate bonds towards companies that emit less carbon, giving each firm a score based on their performance, goals. This etf is invested in a portfolio of dim sum bonds, which are issued outside of mainland china but are. What do foreign investors buy.