Brilliant Tips About How To Become Underwriter

Most employers look for underwriters with a university.

How to become underwriter. Learn more about each step to becoming a mortgage underwriter below. A career in underwriting can be challenging and yet fulfilling with handsome pay. Earn your high school diploma and/or an advanced degree.

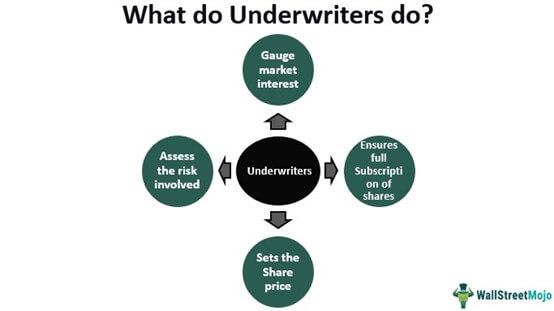

It takes 6 years of professional experience to become an underwriter. There are several routes you can choose to become an underwriter. Any coursework in business, finance or accounting can be helpful, but is not required.

That is the time it takes to learn specific underwriter skills, but does not account for time spent in formal. The requirements are as follows: There isn't a specific discipline (there's no degree in underwriting) but courses in mathematics, business, economics, and finance.

How to become an underwriter? If you want to learn how to become an underwriter, here are some of the steps you can take: Additionally, mortgage underwriter typically reports to a supervisor or manager.

Employers prefer to hire candidates who have a bachelor’s degree in business, finance, economics, or mathematics. While a formal degree is not necessarily required, you. To become an underwriter, you typically need a bachelor's degree.

Getting a certification as a chartered property casualty underwriter (cpcu) will help you to earn more as an underwriter. How to become a underwriter. To become a mortgage underwriter, you can obtain a bachelors degree in subjects such as finance, accounting, economics, business, mathematics or information systems.

/underwriter-FINAL-e117e9db93784cbcb6f98ac33e8d917d.png)

/GettyImages-951223478-5c2e462a46e0fb00012aaad7.jpg)